Buyers

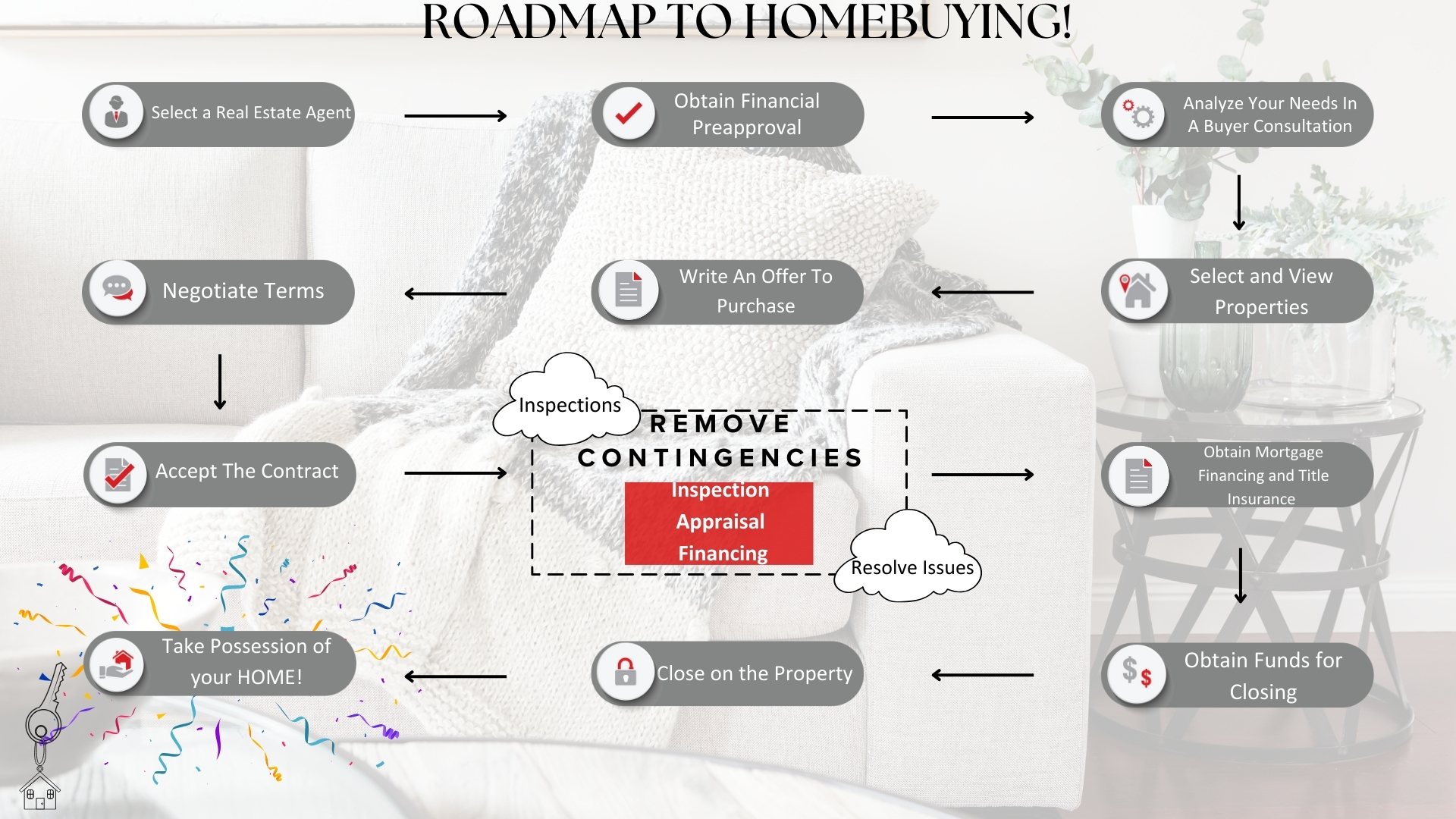

Purchasing a home is a significant milestone. Whether it's your first house, your dream residence, or an addition to your investment portfolio, it's a substantial commitment.

Recognizing its importance, our team of specialists is here to help you discover the property that perfectly aligns with your individual needs.

With a deep understanding of the real estate market and a passion for the industry, we guide you through every step of the buying journey.

Beyond locating the ideal property, we offer comprehensive support throughout your real estate acquisition. Our role as real estate agents grants us continuous access to professionals across various sectors, from financing to relocation, ensuring a seamless and informed experience for you.

In my experience… A dream home isn’t about size. It’s about how you feel when you walk in the door and can imagine your life unfolding there. Buying a home is more than just a transaction—it’s about your life, your dreams, and your goals. I take the time to understand each client’s needs and lifestyle so I can help you find the perfect home for you. It’s an honor to be apart of this exciting journey with you, and I look forward to helping you find your perfect home!

Want to Buy Your New Home Before you Sell?

Step 1

Get your loan pre-approved

By getting pre-approved before starting your home search, you’ll be able to determine what you can comfortably afford and allow us to move quickly once we find the right home.

Pre-approval shows that you are a serious buyer.

What You need to Know

- Tax records

- Pay stubs

- Account statements

- Proof of funds

- Credit check

Step 2

Start looking at potential homes

Time to view and select properties!

Work with your agent to narrow your search and schedule SHOWINGS.

- Describe Your perfect home

- When do you need to be in your home by?

- What are your “must haves?”

If you see a home online, at an open house, or in a new development, contact us!

Step 3

Time To Write An offer!

After we present your offer to the listing agent, it will be accepted, rejected, or the seller may make a counter-offer. We’ll use our market knowledge and negotiating skills to help secure the best terms for you.

Be prepared to

- Move quickly once we have found the right home

- Prepare for the earnest money deposit (EMD)

- Provide proof of funds for down payment and closing costs

- Provide pre approval letter

create a letter to the seller

If you see a home online, at an open house, or in a new development, contact us!

Step 4

Carry out home inspections and remove contingencies

Inspection Contingency

The purchase depends on a professional inspection.

Appraisal Contingency

If you see a home online, at an open house, or in a new development, contact us!

Financing Contingency

Financing Contingency

If you’re getting a loan, the sale depends on the home appraising for the agreed price and you securing the loan.

What Happens When An Offer Is Accepted

After the seller accepts your offer:

Schedule a professional home inspection

Purpose of the inspection:

Ensure the property meets required standards

If serious problems are found:

The inspector will inform both you and the seller.We will discuss how to move forward.

Next Steps:

We’ll help you negotiate who will handle necessary repairs (seller, buyer, or shared responsibility).

Goal:

Protect you from unexpected costs and ensure the property is in good condition before finalizing the sale.

Possession of your new home!!

Step 5

Obtain Mortgage Financing And Title Insurance

Mortgage Financing

- The lender approves the loan and approves all final loan details.

- The borrower signs the loan documents.

- Follow all lender requests, NO exceptions.

Watch provided Timeline

Title Insurance

- Title insurance is issued to protect both the buyer and the lender

- Remove any encumbrances

- Obtain title insurance

Protect you from unexpected costs and ensure the property is in good condition before finalizing the sale.

Get Our Buyer's Guide.

Final walk through

- Occurs 5 days before closing.

- Protects buyer and ensures there is no surprises when you move in.

Obtain Funds

- Transfer Funds To Escrow

- Pay Any Outstanding Balance At Closing

Close on the Property

- All documents are signed.

- The lender funds the loan.

- The seller transfers ownership. (Title usually takes 1 day

- The title is recorded.